Leveraging Your Charitable Giving

The holiday season presents a unique intersection where generosity meets financial planning. Leveraging the power of appreciated assets for charitable giving not only aids in supporting meaningful causes but also provides an avenue to potentially reduce tax liabilities, all while avoiding capital gains taxes on these assets.

The Power of Profitable Assets

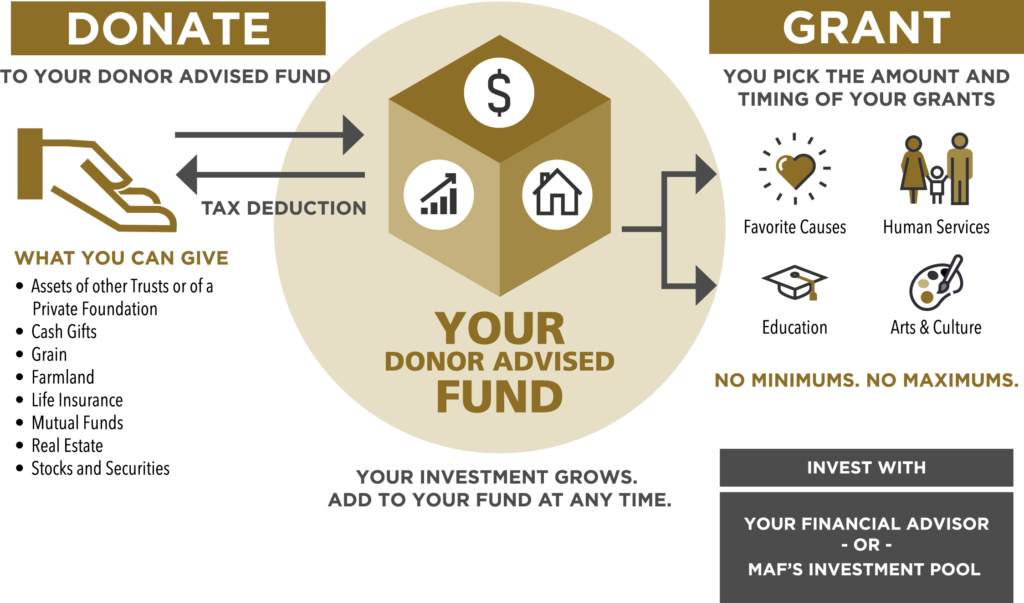

Donating an appreciated asset, such as stocks or real estate, provides you with a unique financial benefit. This act enables you to claim a charitable deduction for the asset's fair market value, effectively reducing your taxable income. Plus, by donating the asset rather than selling it, you bypass the capital gains taxes that would typically arise if you sold the asset. This strategy not only benefits the charity but also aids in minimizing your tax liabilities. However, not all organizations are equipped to handle or process non-cash gifts, so it's advisable to ensure they can accept such donations to make your contribution as seamless and beneficial as possible.

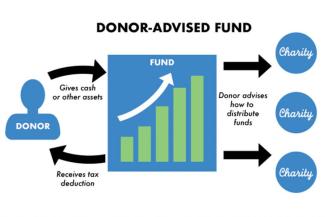

Understanding Donor-Advised Funds

In the U.S., a donor-advised fund, managed by a public charity, facilitates charitable contributions for organizations, families, or individuals. By contributing to a Donor-Advised Fund like the U.S. Charitable Gift Trust® (Gift Trust), you're eligible for an immediate federal income tax deduction. Once your donation is made, you have the liberty to select among eight investment funds or a combination thereof for the investment of your contribution.

Here are some benefits of the donor-advised funds:

- Immediate Charitable Deduction

- Potential for Gifts to Grow Over Time

- Low Costs and Minimal Paperwork

- Supporting Your Preferred Charities

In conclusion, as the holiday spirit fosters a spirit of giving, the synergy of charitable contributions and financial benefits is a win-win scenario. It not only nurtures the joy of giving but also provides opportunities for strategic tax planning that could have lasting, positive impacts for both the giver and the recipients of these generous gifts. Schedule a meeting with the financial advisor to ensure a clear understanding of your options and create a robust plan for your financial future.